s corp tax calculator excel

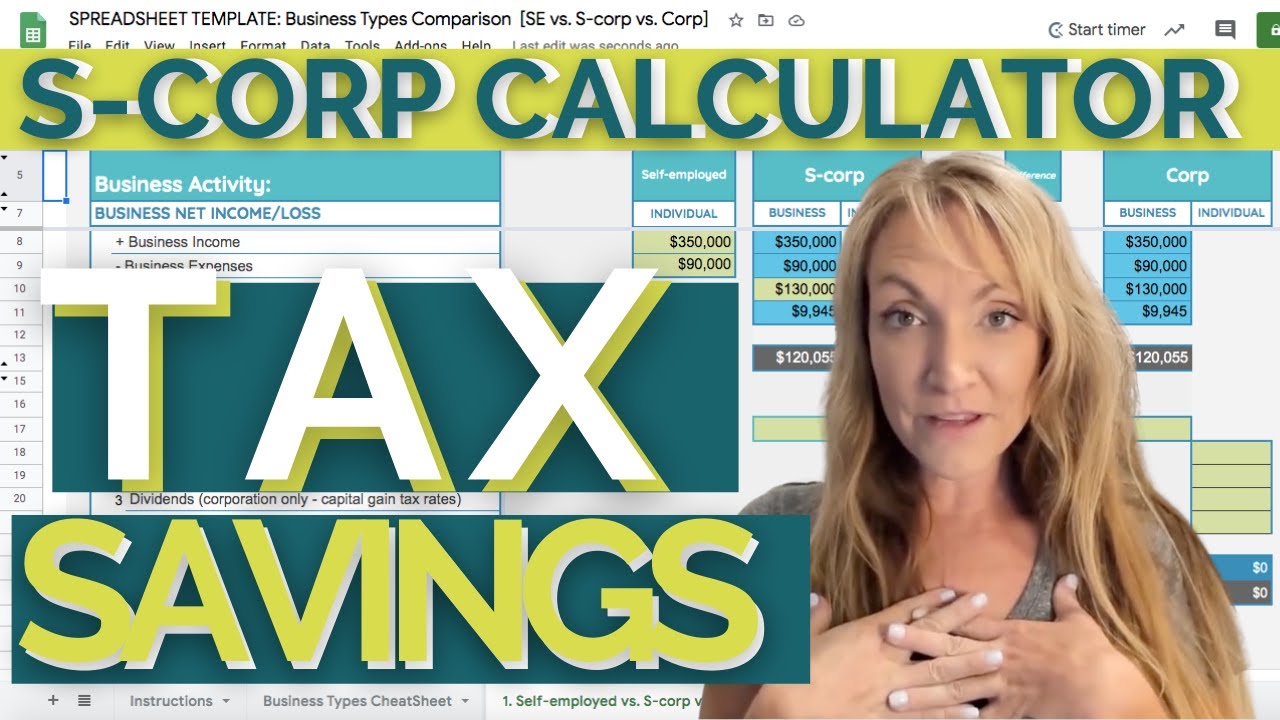

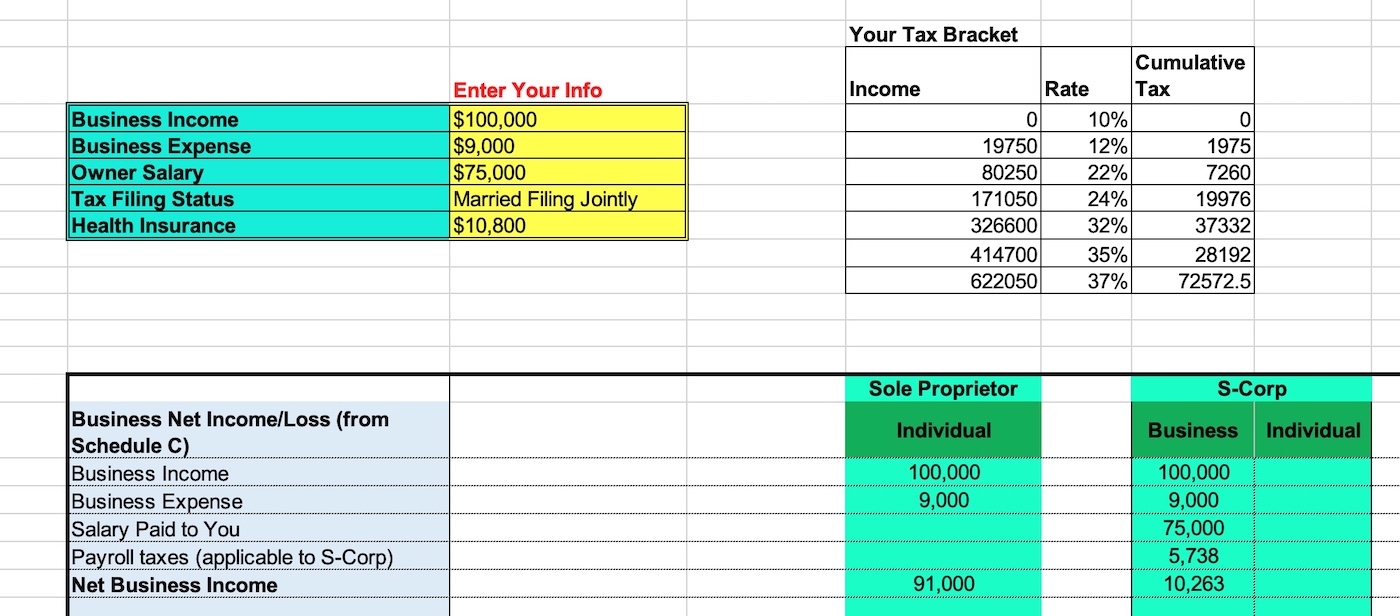

We are not the biggest firm but we will work with you hand-in-hand. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS.

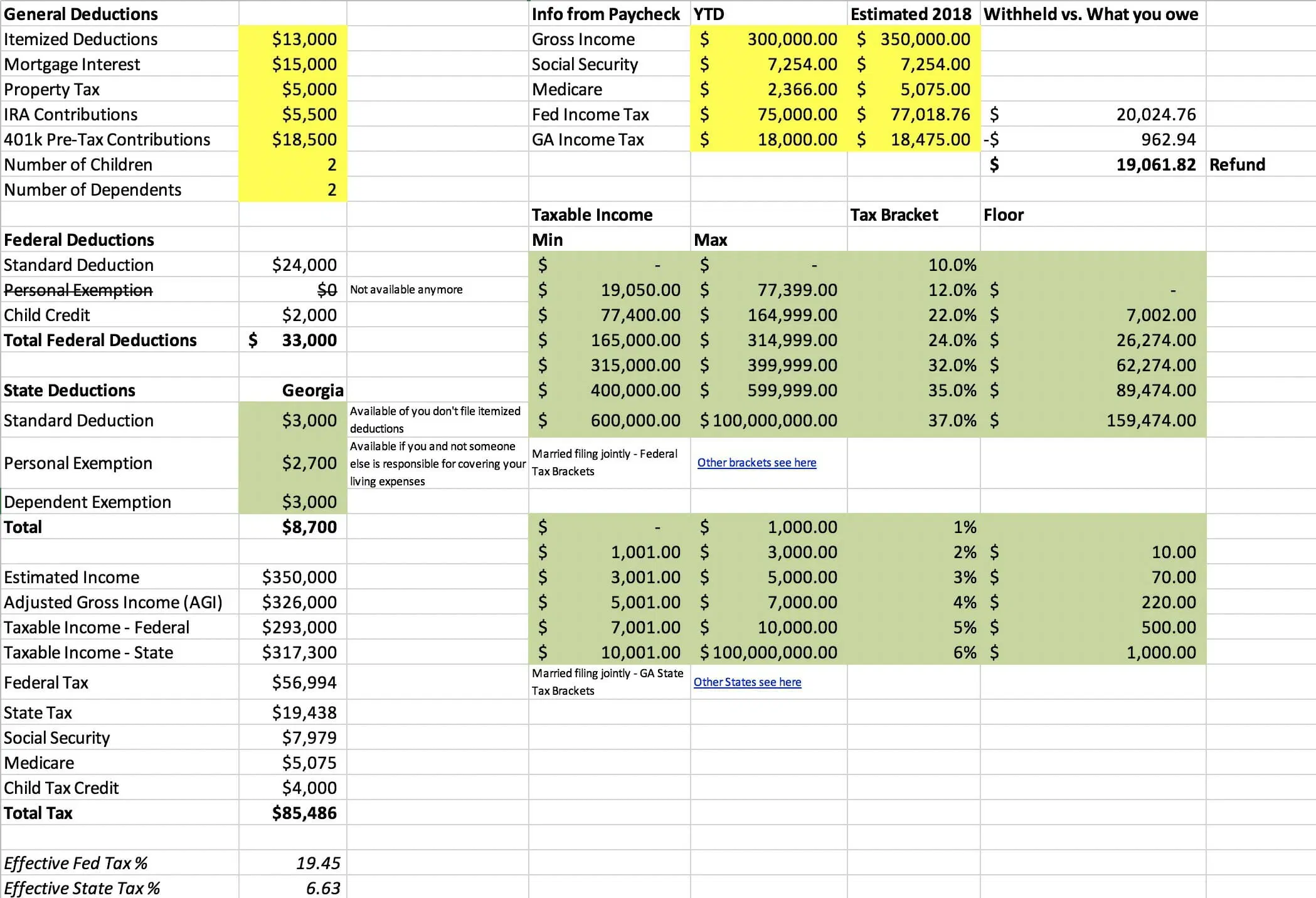

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Check out our S-Corp Tax Saving blog with free video Free S-Corp Blog and Video Free Consultation S-Corp formation done right the first time.

. Completing a Tax Organizer will help you avoid overlooking important information and contribute to an efficient preparation of your tax returns. How to calculate stock and loan basis in an S Corp for tax. Now if 50 of those 75 in expenses was related to meals and.

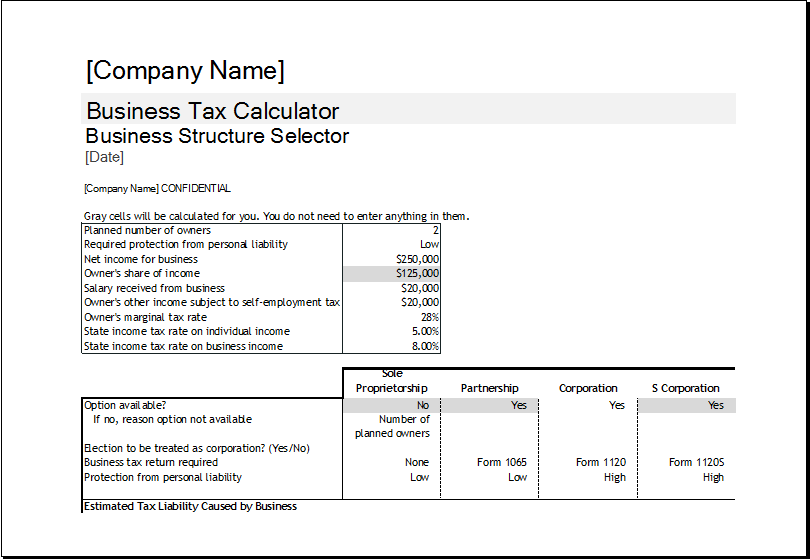

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and local income tax purposes that is elected by either an LLC or a corporation. The entity compares tax rates across S C and limited liability corporations. Calculator for taxation LLCs vs.

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. Regardless if youre self-employed or an employee you have to pay Social Security and Medicare taxes to the government. Get the spreadsheet template HERE.

Here is a calculator which allows you to calculate what your effective tax rate would be for each type of business entity. Forming operating and maintaining an S-Corp can provide significant tax benefits. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

In LLCs and sole proprietorships these tax obligations are shared between the employer and. You calculate it is debt the spreadsheet to calculate s corp basis spreadsheet below gives you can be a special election. Please do as follows.

S corps are not taxed at the business level so there is no double taxation as in a C corporation. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers.

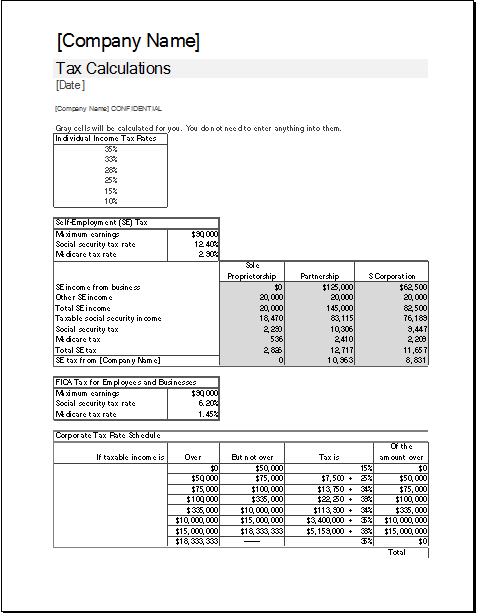

On this page you will find. From the authors of Limited Liability Companies for Dummies. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

Say you earn 150000 in revenue as the owner of a consulting firm. Effective Rate S-CorpLP Taxable Income Owners salary QBI Formula 1 Deduction Formula 2 Deduction Phase-In Deduction Limit 199A Deduction 199A Deduction Deduction of 12 SE Tax Income after deductions. Lets look at some numbers to see how this works.

Self-employed individuals must pay both Social Security and Medicare taxes. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. How Starting an S Corp Could Lower Your Taxes by 5000 Tax.

Instructions for Downloading the S-Corp Tax Organizer for your Business How. Heres how your taxes stack up as a sole prop vs. Forming an S-corporation can help save taxes.

In the tax table right click the first data row and select Insert from the context menu to add a blank row. Find out how much you could save in taxes by trying our free S-Corp Calculator. An S corporation also might estimate reasonable compensation by.

In an S corp business owners are salaried. But as an S corporation you would only owe self-employment tax on the 60000 in salary 60000 x 153 9180 resulting in a savings of 4590. Reduce your federal self-employment tax by electing to be treated as an S-Corporation.

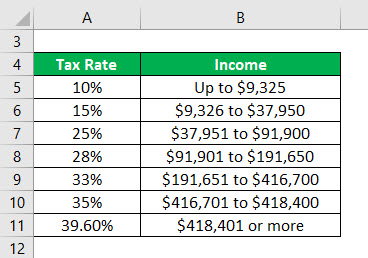

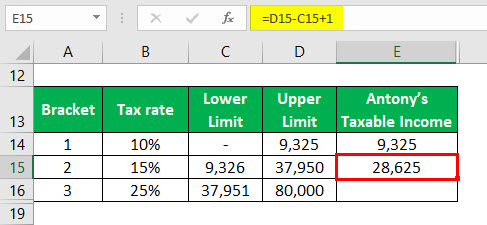

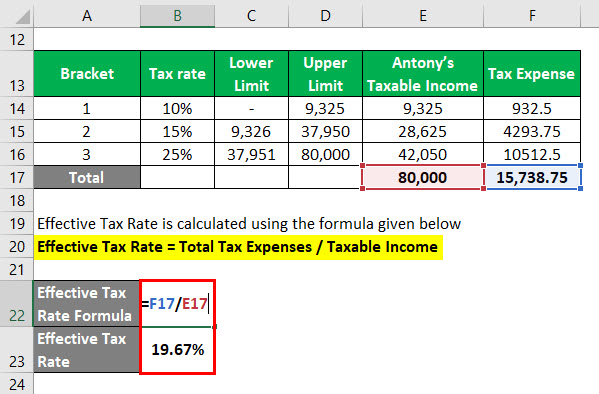

Instead you only pay payroll taxes on the salary you earn from your S corp. VLOOKUPTaxableIncomeFederalTaxTable4 TaxableIncome - VLOOKUPTaxableIncomeFederalTaxTable1 VLOOKUPTaxableIncomeFederalTaxTable3 State Tax. Start Using MyCorporations S Corporation Tax Savings Calculator.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. PAyroll taxes paid as an s-corporation With a salary of and a dividend of. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through deductions for passthru entities and the.

Inside basis is 60000. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. AS a sole proprietor Self Employment Taxes paid as a Sole Proprietor.

Excel Formula to Calculate Tax Federal Tax. When you work for someone else youre only responsible for part of these taxes while your employer pays the balance you pay about 765 and your employer. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

S-Corp Tax Savings Calculator. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. 1 Select an answer for each question below and we will calculate your S-corp tax savings.

This calculator helps you estimate your potential savings. There is not a simple answer as to what entity is the best in terms of incorporation. Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to begin.

Lets start significantly lowering your tax bill now. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. A What is your estimated yearly net income revenue less expenses for the business.

Select the cell you will place the calculated result at enter the formula SUMPRODUCT C6C12. Social Security and Medicare.

Wacc Formula Excel Overview Calculation And Example

Corporate Tax Calculator Template For Excel Excel Templates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Effective Tax Rate Formula Calculator Excel Template

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Estate Tax Examples Of Estate Tax Estate Tax Rate

The Business Spreadsheet Template For Self Employed Accounting Taxes Llcs Youtube

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Effective Tax Rate Formula Calculator Excel Template

![]()

S Corp Vs C Corp Which Is Best Excel Capital Management

Microsoft Excel Use Excel To Quickly Count Workdays Journal Of Accountancy

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Corporate Tax Calculator Template For Excel Excel Templates

Effective Tax Rate Formula Calculator Excel Template

Use Ifs Function To Calculate Letter Grades In Excel Extra Credit